Private Lender Radar

View detailed origination activity from private lenders. Access a complete list of lenders along with their borrowers' contact information.

1

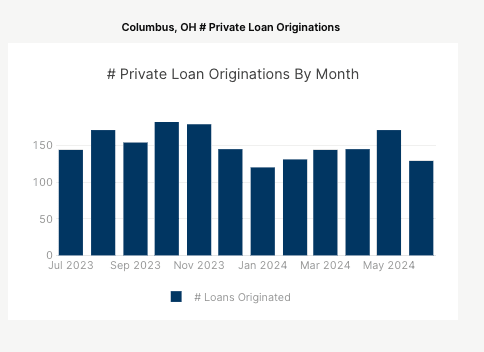

Market Data

View market share for every lender and how it's changed over time.

1

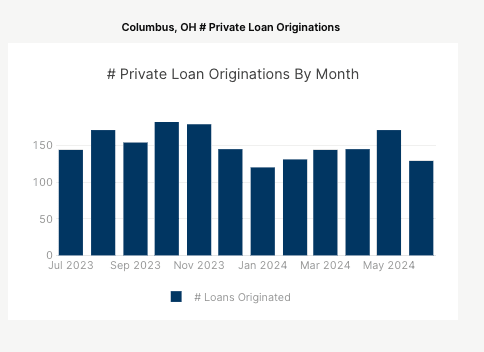

Market Data

View market share for every lender and how it's changed over time.

1

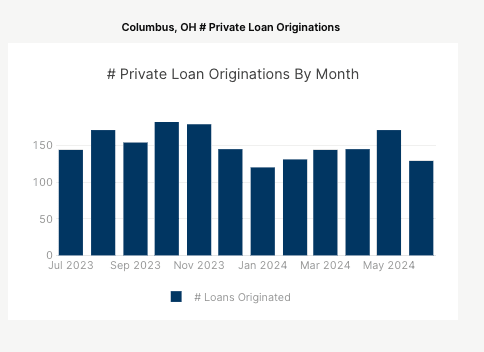

Market Data

View market share for every lender and how it's changed over time.

1

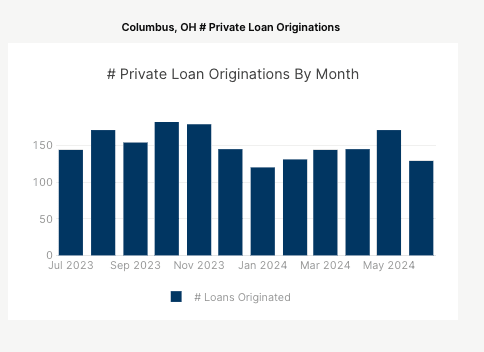

Market Data

View market share for every lender and how it's changed over time.

2

Lender Details

Find all of a lender's borrowers and their origination counts/volumes.

2

Lender Details

Find all of a lender's borrowers and their origination counts/volumes.

2

Lender Details

Find all of a lender's borrowers and their origination counts/volumes.

2

Lender Details

Find all of a lender's borrowers and their origination counts/volumes.

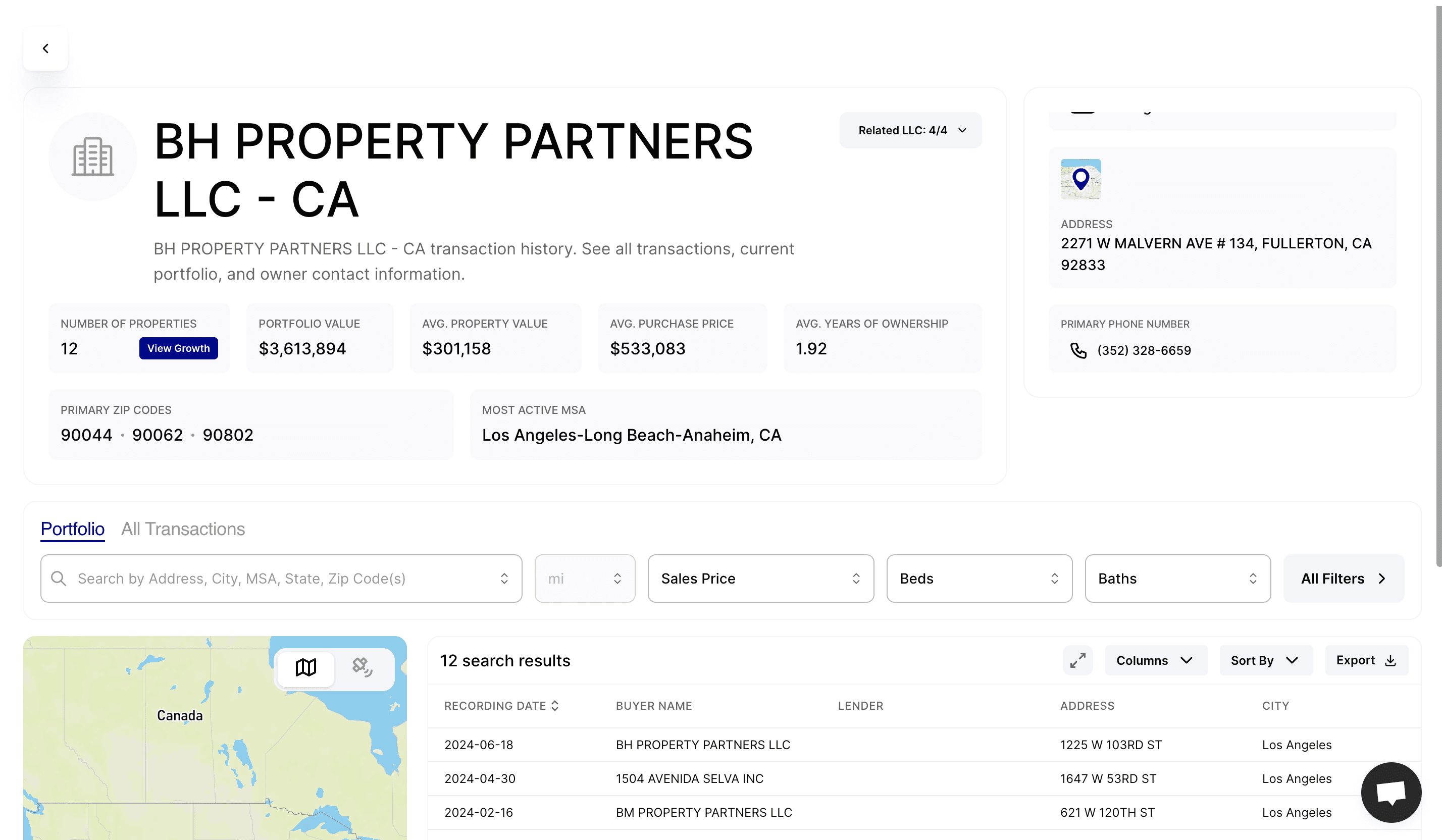

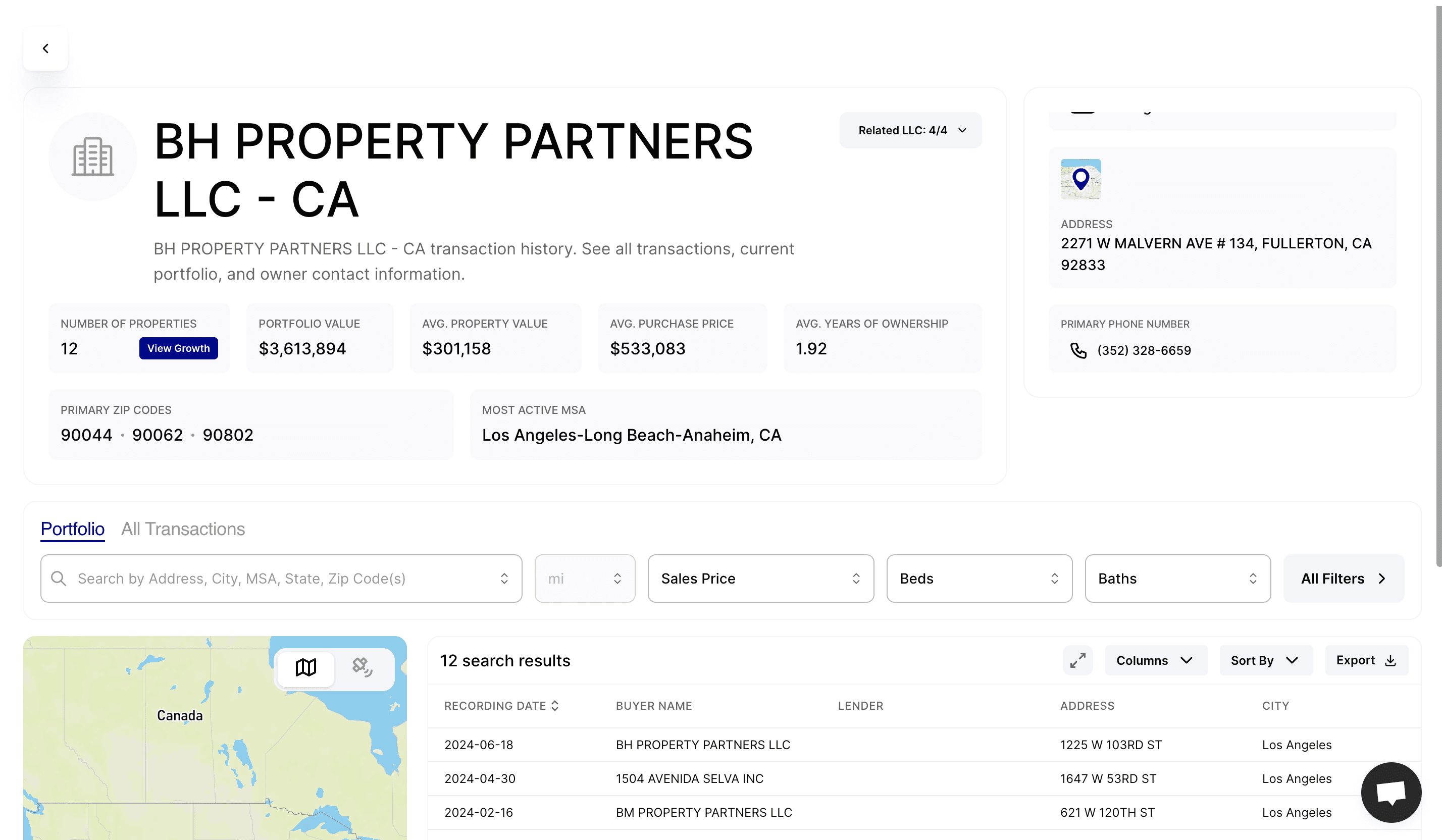

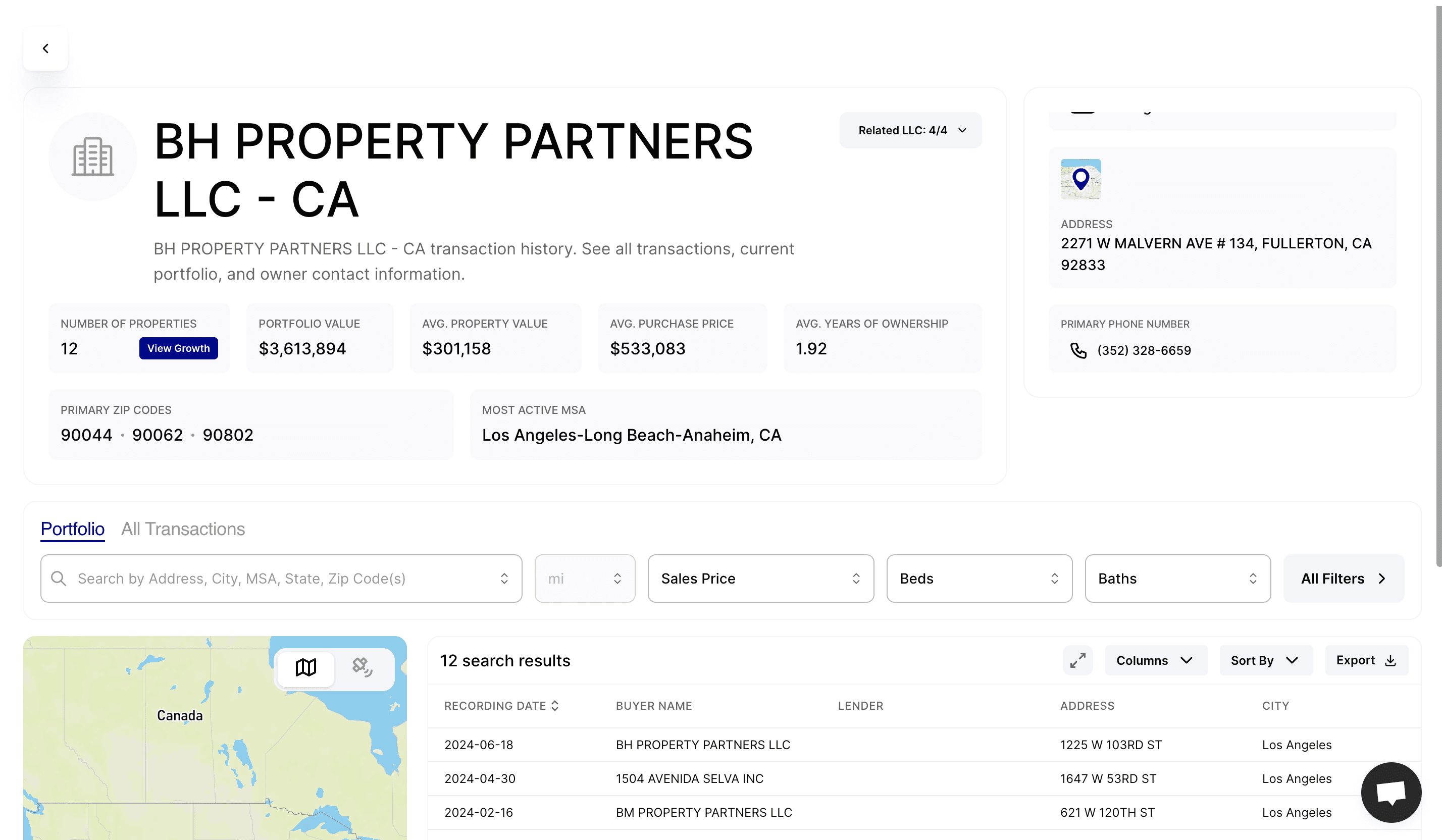

3

Borrower Drill Down

See borrower's wallet share, current holdings, and past transaction history.

3

Borrower Drill Down

See borrower's wallet share, current holdings, and past transaction history.

3

Borrower Drill Down

See borrower's wallet share, current holdings, and past transaction history.

3

Borrower Drill Down

See borrower's wallet share, current holdings, and past transaction history.

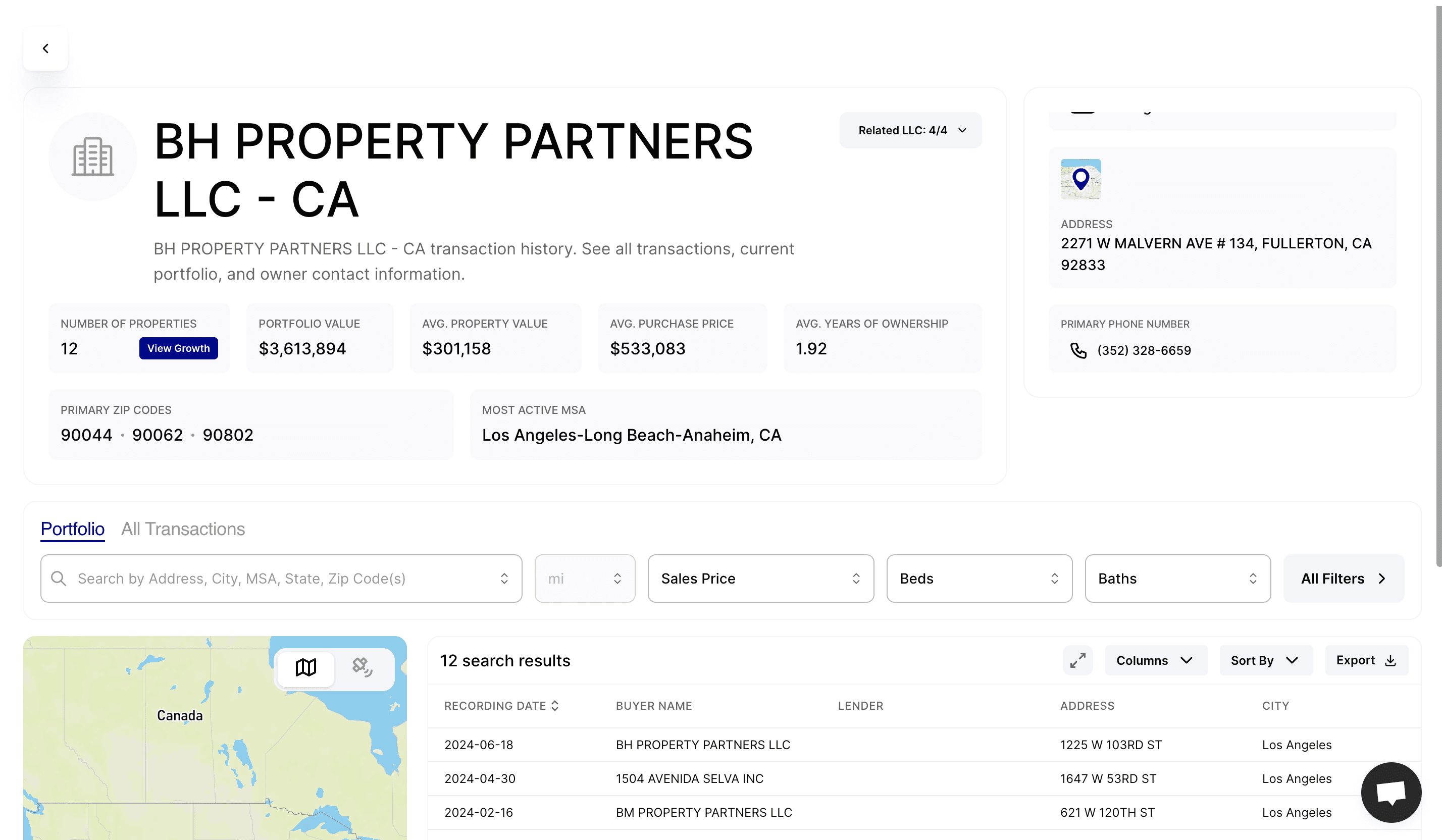

4

Borrower Contact Details

Get accurate contact info for borrower's nationwide.

4

Borrower Contact Details

Get accurate contact info for borrower's nationwide.

4

Borrower Contact Details

Get accurate contact info for borrower's nationwide.

4

Borrower Contact Details

Get accurate contact info for borrower's nationwide.

Generate more loans with SFR Analytics

Verified Contact Info

We offer verified contact info on borrower's of your choosing. Have a team cold calling? They'll love our data.

Verified Contact Info

We offer verified contact info on borrower's of your choosing. Have a team cold calling? They'll love our data.

Verified Contact Info

We offer verified contact info on borrower's of your choosing. Have a team cold calling? They'll love our data.

Verified Contact Info

We offer verified contact info on borrower's of your choosing. Have a team cold calling? They'll love our data.

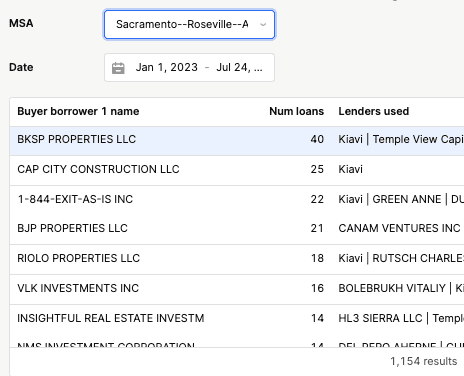

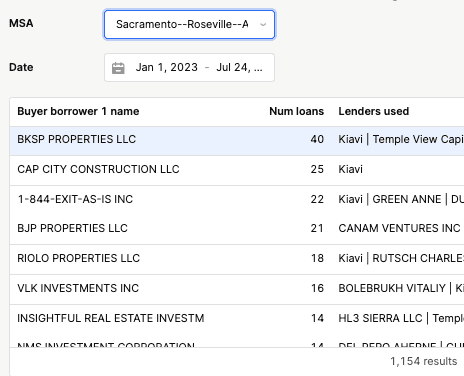

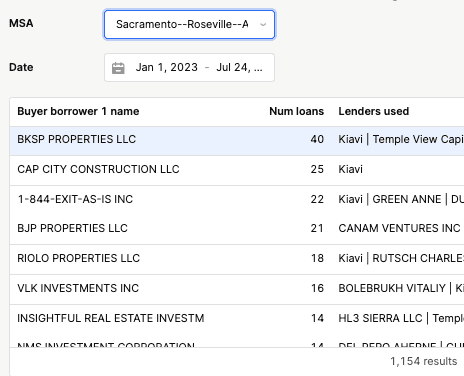

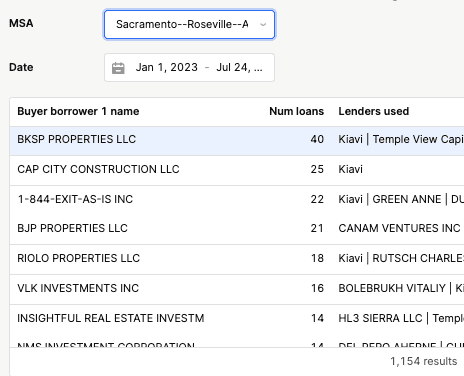

Most Active Borrowers

See the most active borrowers for a given region and period of time. Find out who's financing them and what their current portfolio is.

Most Active Borrowers

See the most active borrowers for a given region and period of time. Find out who's financing them and what their current portfolio is.

Most Active Borrowers

See the most active borrowers for a given region and period of time. Find out who's financing them and what their current portfolio is.

Most Active Borrowers

See the most active borrowers for a given region and period of time. Find out who's financing them and what their current portfolio is.

Advanced Market Intel

Propietary analytics for bridge, new construction, DSCR, and portfolio loans. Ad-hoc analysis available.

Advanced Market Intel

Propietary analytics for bridge, new construction, DSCR, and portfolio loans. Ad-hoc analysis available.

Advanced Market Intel

Propietary analytics for bridge, new construction, DSCR, and portfolio loans. Ad-hoc analysis available.

Advanced Market Intel

Propietary analytics for bridge, new construction, DSCR, and portfolio loans. Ad-hoc analysis available.

FAQs

FAQs

FAQs

How good is the contact information provided for borrowers?

We have industry-leading coverage and connect rates. We use a combination of automated and manual verification to deliver contact information. Additionally, we are happy to dedicate additional human hours to enriching data to ensure it meets your needs.

How good is the contact information provided for borrowers?

We have industry-leading coverage and connect rates. We use a combination of automated and manual verification to deliver contact information. Additionally, we are happy to dedicate additional human hours to enriching data to ensure it meets your needs.

How good is the contact information provided for borrowers?

We have industry-leading coverage and connect rates. We use a combination of automated and manual verification to deliver contact information. Additionally, we are happy to dedicate additional human hours to enriching data to ensure it meets your needs.

How good is the contact information provided for borrowers?

We have industry-leading coverage and connect rates. We use a combination of automated and manual verification to deliver contact information. Additionally, we are happy to dedicate additional human hours to enriching data to ensure it meets your needs.

How should I think about the ROI of the tool?

Most of our customers think about measuring ROI for the tool based on the number of new loans their company is able to make. For most customers, the tool generates enough ROI in 1-2 months to cover an annual subscription.

How should I think about the ROI of the tool?

Most of our customers think about measuring ROI for the tool based on the number of new loans their company is able to make. For most customers, the tool generates enough ROI in 1-2 months to cover an annual subscription.

How should I think about the ROI of the tool?

Most of our customers think about measuring ROI for the tool based on the number of new loans their company is able to make. For most customers, the tool generates enough ROI in 1-2 months to cover an annual subscription.

How should I think about the ROI of the tool?

Most of our customers think about measuring ROI for the tool based on the number of new loans their company is able to make. For most customers, the tool generates enough ROI in 1-2 months to cover an annual subscription.

What regions does the data cover?

We have support for nationwide coverage of data.

What regions does the data cover?

We have support for nationwide coverage of data.

What regions does the data cover?

We have support for nationwide coverage of data.

What regions does the data cover?

We have support for nationwide coverage of data.

What's the best way to use the tool?

We've found that customers get the most out of the tool by using it to drive more effective sales and marketing. In particular, the tool is highly effective for generating new leads via outbound sales.

What's the best way to use the tool?

We've found that customers get the most out of the tool by using it to drive more effective sales and marketing. In particular, the tool is highly effective for generating new leads via outbound sales.

What's the best way to use the tool?

We've found that customers get the most out of the tool by using it to drive more effective sales and marketing. In particular, the tool is highly effective for generating new leads via outbound sales.

What's the best way to use the tool?

We've found that customers get the most out of the tool by using it to drive more effective sales and marketing. In particular, the tool is highly effective for generating new leads via outbound sales.

Grow Your Lending Business

Grow Your Lending Business

Grow Your Lending Business

Find ideal borrowers and reach out to them with a personalized pitch. Win more business.

Find ideal borrowers and reach out to them with a personalized pitch. Win more business.

Find ideal borrowers and reach out to them with a personalized pitch. Win more business.

Resources

Resources

Resources

Resources